I don’t know how I missed this story, but I made the prediction that this would happen last summer. It is going to be a GAME CHANGER!!!

-

Search It!

-

Recent Entries

-

Links

I don’t know how I missed this story, but I made the prediction that this would happen last summer. It is going to be a GAME CHANGER!!!

Last week’s WSJ article, Google Sees Amazon, Facebook, Kayak as Competitors, highlights what Google considers to be their competitors based on their Annual Report. For the first time, Google is not just considering Microsoft and Yahoo competitors, but has added a host of companies in the ecommerce space, such as eBay, Kayak, Amazon, and even social networks.

Looking at it from their point of view, I guess I understand. But as I’ve been thinking about Google from a retail perspective, I’ve seen them as a larger threat to the eCommerce platform and service providers – not the marketplaces or social networks.

Amazon and eBay are two of Google’s largest search customers. So if I were Google, I’d think of those entities as partners versus the competition. Just a thought…

Elastic Path, a leading ecommerce platform, is a partner of mine. I admire their company and product and LOVE their blog – www.getelastic.com. As a holiday gift, they sent me a desktop calendar they created that offers an ecommerce tip of the day for 2010.

After traveling all week, I returned home last Friday to go through the week’s tips. Having just started a segment on my blog about marketplaces, the January 6th tip made me laugh out loud. It read, “Just because Amazon (or your competitor) does something, it doesn’t mean it will work for your site. It doesn’t mean it’s working for Amazon. Test for yourself.”

My first thought was, “Yes, they are talking to you, Walmart!!!”

This is not news, but while we are on the subject of marketplaces, I’d like to take some time to talk about Walmart. Let me preface this post by saying that I’m a big fan of Walmart. They are a former client of mine and I have a great deal of respect for the executives with whom I’ve interacted over the years. However, I am not convinced that they are in the best position to compete in the marketplace arena and as more channels emerge are running the risk of creating a fragmented brand across those channels. It’s hard to critique the world’s largest retailer, so here is my rationale mapped back to the Marketplace Success Driver framework ($100 to anyone that can come up with a better name for that…seriously) I established last week.

REACH: This is a no brainer. Walmart is Walmart. They have the reach. Let’s move on.

RELEVANCY: Let’s examine relevancy based on the questions I posed last week. Are they filling a gap in the marketplace or are they better suited to provide a service in the marketplace? I’d say No. Amazon pretty much has this covered.

Does the marketplace offer the right products? Not at this point. With the addition of three retailers (Proteam, CSN, and eBags) as third party sellers, I don’t see much value being added to the existing product offering. And what will happen when partners offer the same products but are unable to match Walmart on price. What good does that do anyone?

Is it a concept relevant to the needs of Walmart’s customer base? Walmart proved that consumers want to and will buy everything they can in one place – toiletries, tires, chicken wings, jeans – when they began popping up Supercenters ten years ago. People like convenience. But Walmart.com is not the same as Walmart’s physical stores. And before they invest more time and energy into a growing a marketplace, I’d like to see them focus on building a stronger foundation for Walmart.com that operates much like the physical store – a point on which I’ll elaborate more when I talk about user-centricity.

TRUSTWORTHY CONNECTIONS: Unlike Amazon and eBay, Walmart is heavily vetting the sellers they let into the marketplace – understandable considering their credibility is on the line when opening up their customer base to third parties. It’s great that they’re being careful, but how can they possibly offer breadth to consumers at this rate compared to Amazon who has millions of 3rd party sellers?

However, with the partners they do have they’re offering the same trust-building tools – pre-purchase notifications, retailer scorecards, ratings & reviews, etc. So as they add new sellers over time, they can ensure that they have the tools in place to build trust right out of the gate. But as I mentioned in the Sears post yesterday, trust takes time to build.

USER-CENTRICITY: Walmart.com is a mediocre shopping experience. Walmart’s physical stores are carefully organized according to how consumers shop. They aren’t the most fancy stores but they don’t have to be. They’ve nailed the brick-and-mortar set-up all the way from store layout to merchandising within departments.

In my opinion, Walmart.com is organized according to how media companies buy advertising space. Much like Sears, the experience as a whole is extremely busy. The categorization of the products is different than the “departments” in the physical store. And the advertising is a total distraction from the shopping experience.

I don’t see advertising for Applebee’s in the garden department at Walmart. So why would I see banner ads for eggbeaters in the apparel section of Walmart.com? From a business model perspective, I understand why Walmart.com sells banner space. But I guarantee I could develop a stronger business model for how Walmart.com could maximize that valuable real estate to sustain the digital business, drive greater conversion on products within their store AND provide added value that is a differentiator for both their target customers and existing and potential sellers.

I bring this up because I honestly believe that until Walmart offers a user-centric experience, they will never begin to catch up to their competitors and establish a marketplace that truly thrives.

Walmart and Walmart.com may operate as two separate companies, but they aren’t two separate brands. Walmart needs to create a true multi-channel strategy. They need to ditch the classifieds concept, implement a new strategy for Walmart.com, start testing digital and mobile in-store and then expand their footprint as a marketplace with partnerships and acquisitions that reinforces their brand. Only then will they be able to compete with Amazon.

Posted in ecommerce, Marketplaces, Multi-Channel, retail

Last week Sears announced the launch of their own marketplace, touting that they would offer consumers “more than 10 million products from more than 1,500 sellers across 400 categories.” Sounds like a great idea. Except for a few things. Here are my thoughts mapped back to the framework I presented last week.

REACH: How will Sears ever build the traffic necessary to support a marketplace that offers over 10 million products? With a quick reach comparison between Sears and Amazon, Walmart, and eBay, it seems that Sears has a long, challenging battle ahead of them to capture the eyeballs necessary for success. It’s not impossible, I’m just not sure they will be able to compete.

RELEVANCY: Will Sears be able to expand their brand in consumers’ minds as a “one stop shop” for a large variety of goods? Amazon proved in 2009 they were so much more than a marketplace for books, dvds, and video games. But I’m skeptical that the mass-merchants trying to do the same will see the same success. Walmart is trying, but has a long way to go. And Sears, I’m afraid has an ever longer haul ahead of them.

TRUSTWORTHY CONNECTIONS: If Sears can increase reach and prove to be relevant to their target consumer segments, then they face the trust challenge. Sears has product reviews (one of the top features for building trust and driving conversion), but will they offer this functionality to the sellers? Probably so. And I’m sure Sears is offering sellers a mechanism for receiving ratings and testimonials. But both of these features – product reviews and seller ratings tools – take time to accumulate and add value. The longer it takes for consumers to feel comfortable buying from sellers outside the Sears network, the larger the gap grows between Sears and the competitors.

USER-CENTRICITY: At first glance, I think the Sears user experience lacks focus and isn’t centered around the customer – whether that be a buyer or seller. It honestly seems like they tried to offer every tool, feature, and piece of content under the sun without giving real thought to how consumers use them. I was overwhelmed at every stage of the browsing process. Every page on this site is extremely busy. My brain couldn’t calm down enough to focus on where to go next. Here are two examples of poor site experience.

USER-CENTRICITY: At first glance, I think the Sears user experience lacks focus and isn’t centered around the customer – whether that be a buyer or seller. It honestly seems like they tried to offer every tool, feature, and piece of content under the sun without giving real thought to how consumers use them. I was overwhelmed at every stage of the browsing process. Every page on this site is extremely busy. My brain couldn’t calm down enough to focus on where to go next. Here are two examples of poor site experience.

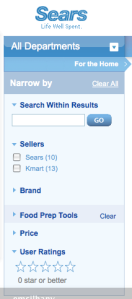

The filtering at the category level needs significant improvement. I’m not certain sellers should be the first filter consumers would use in the very long list of options. And sometimes too many options are worse than not enough. And as I clicked through the various filters, the results weren’t properly mapped to my selections. This is a common problem when companies map products back to industry categories or based on how they classify them within their own departments. Poor classification takes all of the value out of filtering tools.

The filtering at the category level needs significant improvement. I’m not certain sellers should be the first filter consumers would use in the very long list of options. And sometimes too many options are worse than not enough. And as I clicked through the various filters, the results weren’t properly mapped to my selections. This is a common problem when companies map products back to industry categories or based on how they classify them within their own departments. Poor classification takes all of the value out of filtering tools.

User testing and site analytics will tell the full story over time, but I know I had a hard time narrowing down my selections when searching for exercise DVDs. In fact, I ended up getting a result for a video titled “Sex Madness” in the Fitness category.

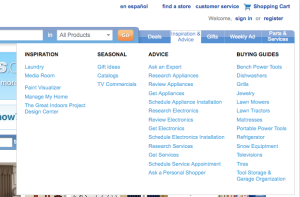

In my opinion, the biggest missed opportunity comes with the Ideas and Inspiration features and content. While the site offers great tools for moving consumers through the shopping funnel, the organization of this content needs to be reworked.

In my opinion, the biggest missed opportunity comes with the Ideas and Inspiration features and content. While the site offers great tools for moving consumers through the shopping funnel, the organization of this content needs to be reworked.

It would be great if users could click on the Ideas and Inspiration tab and enter a portal that serves as a hub for these resources. The content and labels’ naming conventions could be more relevant and better organized. And it would also be nice to see snippets from each piece of content/functionality as a preview before leaving the portal page.

After some basic reorganizing of content, it would be very helpful if users could see what resources other consumers found most helpful along their journey, tag these resources, and share them with their friends. One more suggestion – how about letting your sellers provide some of this content? What a great way to a) offset some of the content creation responsibilities and b) foster trust between buyers and sellers!

To test out the experience, I clicked on “Jewelry” under the Buying Guides header I was taken to this page to the left. I don’t even know what to do here. And had I not scrolled down, I would’ve missed the content specific to jewelry.

To test out the experience, I clicked on “Jewelry” under the Buying Guides header I was taken to this page to the left. I don’t even know what to do here. And had I not scrolled down, I would’ve missed the content specific to jewelry.

In addition to the Ideas and Inspiration area, Sears should be surfacing these content nuggets and features contextually throughout the shopping experience. When I checked out the jewelry category page, there were no call-outs pointing to this content.

Those are just a few examples of how I think Sears is lacking in terms of offering a solid customer experience. What I find most unfortunate is that these features and content, with a more user-centric execution, could differentiate Sears from its competitors.

To be fair Sears only official opened up the marketplace to outside sellers this week. I’m interested to see how the next few months unfold. I think they have a long road ahead of them, but only time will tell if they will be able to differentiate themselves from the existing marketplaces and gain some of their competitors’ share of wallet.

Amazon’s success in transforming itself from a marketplace for books into a marketplace for books AND almost everything else forced Walmart to take notice and get into the game. The demand of global commerce and the abundance of excess inventory enabled eBay to expand its brand from a bidding platform to a channel for retailers to move secondary goods, as well as an outlet for selling outside the US. And we can’t forget the ever-increasing popularity of Etsy as a marketplace for niche handmade goods. The company saw explosive growth in 2009 contributing to the increase among many to jump on the marketplace bandwagon.

Back in October of last year in the post “What’s in store for 2010,” I wrote that marketplaces were going to be hot in 2010. But I failed to mention that not all emerging marketplaces were going to be successful.

This got me thinking. What enables success in the marketplace? Many factors may contribute to a marketplace’s success. But in order to win, a marketplace must have reach among a consumer segment, be relevant to the consumer segments’ needs and/or desires, and drive trustworthy connections through a user-centric system. Or in simple terms:

REACH: The attention of buyers and sellers. Very simple.

RELEVANCY: Is it filling a gap for consumers or better suited to provide a service than existing competitors? Do they have the right concept, right products, right tools, etc?

TRUSTWORTHY CONNECTIONS: Connections can’t be made without reach. And once you have the reach, you still need to connect buyers and sellers for a marketplace to be effective (or really to even be a marketplace at all). Trust needs to be built between buyers and sellers, buyers and products, marketplace and buyers, AND marketplace and sellers. Trust takes time (sometimes a long time) to build. All existing marketplaces have a different approach to building trust. Whether it’s expansive user-reviews on products, seller and buyer ratings, or retail scorecards, all of the leading marketplaces understand the concept of building trust between connections.

USER-CENTRECITY: The user-experience is the glue that holds it all together. The experience has to cater to all parties and can make or break it all. Amazon has created a user-experience that may not be best-in-class (please someone debate me on this), but they’ve built something that works really well for their customer base.

Over the next week, I’m going to spend some time examining and sharing my thoughts on how the marketplace landscape maps to my framework taking a look at some of the leaders – eBay, Craigslist, Etsy, Amazon, Walmart – and some of the newbies – Groupon and Sears, which will launch it’s new marketplace in the next couple of days.

Posted in ecommerce, Marketplaces

Tagged amazon, commerce, etsy, marketplace, walmart

Throughout December, I’d estimate that I spent 20+ hours a week online checking out the top 100 retailers’ holiday promotions and digital experiences. As a whole I was underwhelmed with how many retailers took advantage of the flexibility digital offers in offering creative approaches to seasonal promotions and experiences.

Most retailers took consumers completely outside of the way they typically shop to a gift-giving destination or, even worse, created experiences that felt like an afterthought. However, J.C. Penney stood out in my mind during the holiday season as taking a very strategic and logical approach to seasonal sales.

Like most retailers, J.C, Penney’s created a centralized experience for gift giving, a concept that isn’t a new or revolutionary tactic. However, it was the implemen tation of the “gift center” that made me take notice. Consumers think differently about gift giving than they do about shopping, a fact that most retailers don’t give thought to when building out holiday campaigns. JCP, however, provided an experience that suited both the gift giver and the shopper mentality.

tation of the “gift center” that made me take notice. Consumers think differently about gift giving than they do about shopping, a fact that most retailers don’t give thought to when building out holiday campaigns. JCP, however, provided an experience that suited both the gift giver and the shopper mentality.

The holiday gift center was very simple – categorized by consumer type (for her, for him, for teens, etc) with the ability to filter by price or browse by classification using very emotive actions – give style, give warmth, give comfy, give sparkle etc. Invoking emotion in consumers without disrupting the shopping process is very difficult to accomplish, yet the JCP experience did just that. I, myself, wanted to explore deeper to see how I could “give comfy” to my mom and “give sparkle” to my sister.

Not only did they create a centralized location for giving, they also brought little pieces of the gift giving experiences into relevant areas of the shopping experience. By carrying the “Give Warmth” or “Give Style” themes into the category pages, they were able to sprinkle gift ideas throughout the typical shopping path without disrupting users by forcing them off the path to a gift-giving destination.

Not only did they create a centralized location for giving, they also brought little pieces of the gift giving experiences into relevant areas of the shopping experience. By carrying the “Give Warmth” or “Give Style” themes into the category pages, they were able to sprinkle gift ideas throughout the typical shopping path without disrupting users by forcing them off the path to a gift-giving destination.

It seems almost too simple, which essentially is the beauty of the approach in itself. It is simple to the user, yet feeds a mindset they don’t even know they have. It doesn’t try to change the way people shop. It just makes their shopping more productive.

Posted in Merchandising, Promotions, retail, User Experience

2010 could not get here fast enough. And with the new year comes new numbers on how retailers performed over the holiday season. I’m anxiously awaiting the reports to see if some of the big changes and new strategies from various retailers paid off as they’d hoped. In the meantime, I’m still catching up on my heavily ignored inbox and piles of research that needs to be consumed in the next 10 days.

I took the the last two weeks off from consulting and blogging but still kept an eye on the retail landscape. I got through about 50 product packets from various retail technology companies and spent a fair amount of time in stores observing holiday shoppers and talking to people about their spending behavior and plans.

Based on reports from the news and the paper, I was expecting to see fewer sales, more shoppers, and much less inventory than in years past. But, in actuality, I saw fewer shoppers and the same amount of sales on larger amounts of inventory.

But in the days leading up to the holidays, I was shocked to find many retail stores, practically empty with what seemed to be a lot of seasonal merchandise (at full price) left to move. Knowing that retailers were “holding off” on sales, I assumed that the merchandise would move when marked down. But for the five stores I visited pre-holiday and post-holiday, all of them seemed relatively empty AND holding onto large amounts of inventory even after dropping the prices.

Knowing the amount of money spent in late November and early December, I assumed that most people had already spent up to their limit for the holidays, leaving them without cash to spend post-holiday and retailers, once again, with excess inventory. This got me thinking about pricing and sales strategies moving forward and how I would address the excess inventory issue if I were in their shoes.

I don’t have an answer today, but in the next few months I plan on crafting a POV on how retailers can use digital to make better buying, pricing, and merchandising decisions to solve this problem. That is one of my New Year’s resolutions!

At the end of the summer, I bought a Gucci handbag that is part laptop bag, part carry-on and perfect for someone who spends the majority of their time on an airplane. It was my first large Gucci purchase and a fairly impulse buy at that.

I saw the bag in a Neiman Marcus email promoting upcoming fall trends. I had to have it and within one click it was on its way. Unfortunately within the first month of using it, the seams on one side started to come apart. I was disappointed. I can justify spending the money on premium designer goods because, usually, they’re made to last.

One day while shopping uptown, I popped into the Gucci flagship store on 5th Avenue. I was heading to dinner but wanted someone to take a look at it and tell me what I should do. I told one of the sales associates that “I didn’t buy it here” but he said to just bring it in when I could leave it and they would fix it.

A few weeks later I brought the bag in and was directed to the store’s accessories manager. I told him the same thing I told the first gentleman, except this time I was a little more clear mentioning that by here I mean at a Gucci store. He told me my options. A) he could send it off for 6-8 weeks to be fixed or B) I should take it back to Neiman’s and get a new bag because “this shouldn’t have happened to a Gucci bag.”

Option A wasn’t an option. I needed the bad for my upcoming travels. Plus, it’s a seasonal bag. I didn’t want to send it off only to get it back all patched up with only a few weeks left to use it. Option B was a pain. There is no Neiman Marcus in NYC. Which meant I would have had to drive to Westchester or Jersey OR ship it back to NM customer service involving a trip to the post office during holiday season.

So the awesome Accessories Manager at the Gucci store had me leave my bag and said he would see what he could do. Not only was he timely in getting things taken care of, he actually ended up replacing my bag for me. And when calling me to tell me left me a message with his work phone AND his cell phone number so I could get my bag (either via pick-up or even courier) before the holidays.

Luxury customer service at it’s finest! And now when I spend the extra cash on a handbag, I will buy it directly from the store versus from another luxury retailer.

In last week’s Wall Street Journal article, Neiman Enlists Designers in Cost-Cutting Plan: Luxury Retailer Pushes Suppliers to Use Fabric in Place of Leather to Lure Middle-Income Shoppers , Vanessa O’Connell and Peter Lattman covered Neiman Marcus’s move to work with luxury designers to create a new tier of merchandise targeted to middle-income shoppers, stating consumers may find “a simple pair of $395 Manolo Blahnik flats” and “classic Manolo napa leather flats that sell for about $675.”

The Neiman Marcus brand has always represented premium merchandise with best-in-class customer service. I know that the shift in the economy requires a shift in strategy. But is pushing designers to create merchandise for the middle-income shopper the right strategy for the retailer? Because I don’t know many middle-income consumers willing to pay $400 for a pair of shoes – even as a splurge.

And does Neimans really want to base their future on a customer segment that doesn’t have a regular need for the products they sell? What happens when they’re offering merchandise that the middle income consumer still can’t afford and the higher income consumer won’t buy?

But certainly this isn’t a new trend for designers. Over the past 18-months, many designers such as Michael Kors and Marc Jacobs have done a great job of expanding their lower tier lines while protecting the integrity of their premium products and their brand.

However, as the article poignantly articulates, not all premium designers have the flexibility in their design and pricing to churn out a lower-end line of products to meet Neiman’s requests, creating the possibility for a rift between supplier and the retailer and the risk that they may take their products direct to consumers.

Will Neimans lose the loyalty of their core customers and the suppliers who have helped them build their brand thus far? This strategy just adds to the argument I’ve been making over the past few months that Neiman Marcus is making decisions that may seem good for the short term, but I think (and this is simply my opinion) prove they are out of touch with their core customer base as well as the middle-income consumer and are at risk to erode the brand they’ve built for over 100 years.

Posted in Merchandising, Operations, retail

Tagged Luxury Designers, Neiman Marcus, Strategy

Yesterday I touched on some opportunities The Gap missed with the execution of their Cheer Factory campaign. Though I’m in danger of sounding like the Retail Grinch, but this latest hiccup by The Limited is too big for me to disregard.

I’m going to share a secret with you. I buy most of my work pants from The Limited. They have a style of pants that is a perfectly suited for my abnormally high waist and long legs at great prices. They also have some great accessories (love this season’s selection of gloves, scarves and tights) which I often buy as gifts.

Since the launch of their ecommerce site, I do most of my shopping with them online as there isn’t a physical store in New York City…usually. But this holiday season they followed suit with other “non-Manhattan dwelling” retailers and opened a pop-up store in Soho.

Amazing! Except for one thing. I didn’t know about it until after I’d already purchased gifts (that I would’ve bought at The Limited) somewhere else. I’m a Limited card holder and on their email marketing list, so they know I live in NYC and they had two ways of reaching me to promote the pop-up store.

But I found out too late. I wonder how many Manhattanites didn’t know either and spent their money on gifts at one of The Limited’s competitors?